News|2022-09-03| BOBETON

Introduction: Despite reports that ADI will raise the prices of products from the whole production line, ADI also mentioned that economic uncertainty is beginning to affect product bookings. It makes the market's sentiment toward chip stocks turn pessimistic again, and since late August, the share prices of U.S. stocks and A-share chip stocks have fallen.

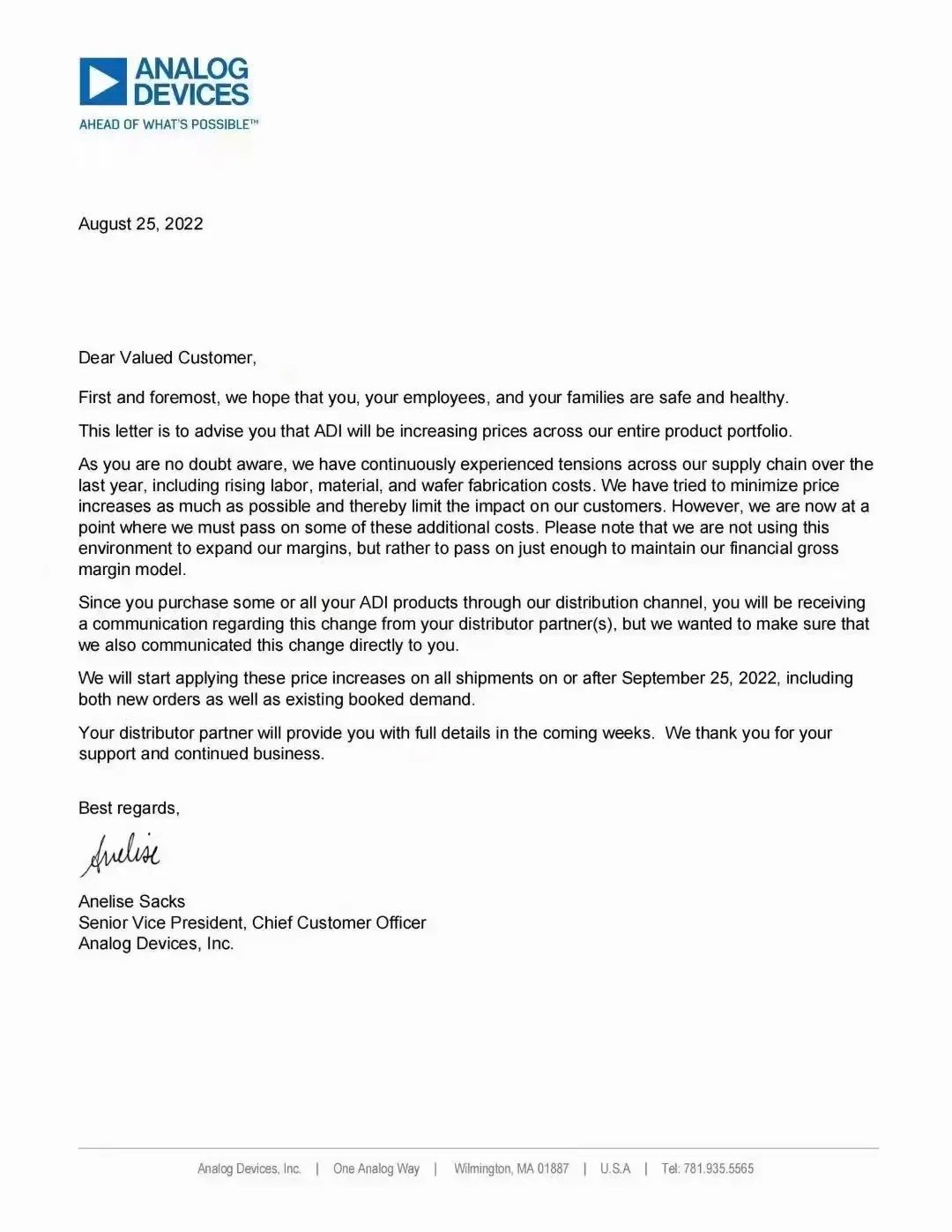

On August 30, according to foreign media reports, analog chip giant ADI issued a price adjustment letter to its dealers, saying, "Due to the impact of inflation on the supply chain in the past year, although we have tried to reduce the impact on end customers, there is no price increase, but now we must raise the price of some models of chip products to maintain our gross margin level." ADI stressed that the price increase was not intended to expand profit margins.

According to the price increase letter circulated in the industry, ADI will increase the price of all products, including new orders and existing reservation needs, but did not disclose the specific increase, the price increase will be implemented from September 25, 2022.

Source: Network

It appears that although ADI stressed that the price increase is not aimed at expanding profit margins. But the move still allowed the market to connect with the signals revealed in the company's third-quarter report released the other day. The company beat expectations on both revenue and earnings per share in the third quarter, with record industrial, automotive and communications revenue.

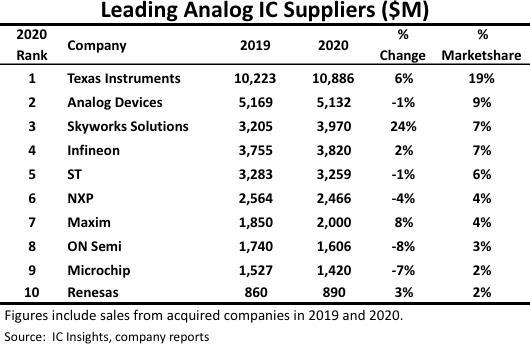

After all, compared with Micron Technology, Nvidia and other chipmakers with close consumer relations, ADI mainly produces high-end analog chips that can be used for heat management and thermal control, and the target market is mainly in industrial and automotive fields, which can avoid the impact to a certain extent in the current weak demand in the consumer electronics end market.

Source: IC Insights

It is well known that in recent years, ADI has focused its attention on the automotive and industrial businesses. In 2021, ADI acquired its rival Maxim, the world's seventh-largest analog chip company, for $28 billion. After the merger of the two companies, ADI will be directly ahead of the leader Texas Instruments in terms of revenue size and market share. Therefore, ADI is the US chip stock that has received more attention during the year, and before its earnings release, it is the large cap stock that has achieved positive returns in the Philadelphia Semiconductor Index this year.

ADI's third quarter revenue grew 77% year-over-year, surpassing $3 billion for the first time. Adjusted earnings per share rose 47 per cent to an all-time high of $2.52, both ahead of analysts' forecasts. However, ADI also acknowledged that economic uncertainty is beginning to affect product bookings; ADI's order intake "slowed" at the end of the second quarter, with "a slight increase in order cancellations."

After all, there is also news that ADI's recent market is still declining overall, agents and clients have a large number of arrivals, resulting in a lot of materials gradually tend to be the market price level before out of stock, even if the overall spot price is still at a high level, but the customer acceptance has been greatly reduced, such as AD7606BSTZ. Some customers target the spot price to be below $7. Even so, ADI is planning another round of price increases.

It is reported that in the past 2 years, ADI prices have been strong. But since April, demand has continued to cool. In May, the demand of hot materials, such as ADUM, ADG, AD7, AD8, is strong, but LTC part of the power management IC prices are low. In June, demand fell even more sharply.

Source: Network

As a result, ADI shares have fallen more than 10% from their year high just reached in mid-August, as the company has expressed concerns about the company's business prospects. In addition, the pessimism of market investors on chip stocks seems to have further intensified. Since late August, Intel, Nvidia, Micron Technology and other US semiconductor stocks have fallen.

In addition, A-share semiconductor stocks have also fallen since late August. To be precise, it staged a wave of "roller coaster" market in August. In early August, the semiconductor industry stocks rose significantly, and the Wind chip index rose by more than 12% in the month, but in late August, the stocks generally retreated.

In any case, for the rebound of semiconductor stocks in early August, some analysts believe that valuation repair may be the main reason. From the perspective of industrial prosperity, the cyclical inflection point of the semiconductor industry may appear next year. From the perspective of sub-industries, although the semiconductor equipment materials sector was affected by the US interest rate hike and the Russia-Ukraine conflict at the beginning of the year, the valuation fell sharply, but the performance still maintained a high growth performance. In the next stage, supported by the triple multiplier effect of accelerating the expansion of domestic fabs, increasing the localization rate of equipment and materials, and increasing the amount of equipment and materials brought by new technologies, the sector is expected to usher in a high performance boom cycle of three to five years.

Copyright © Shenzhen Hongbotong Electronics Co., Ltd